Hello Lovely Savers!

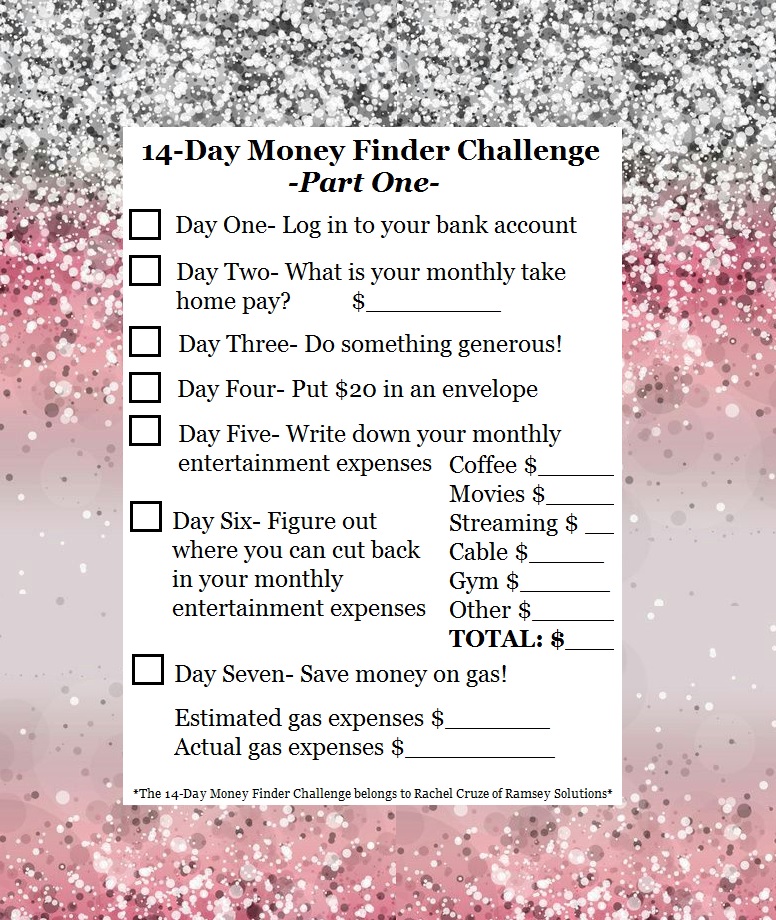

This post we will be looking into the first week of Rachel Cruze’s 14 Day Money Finder Challenge. If you’d like to join her, you can sign up on her website here!

Cruze breaks it down into simple tasks you can do each day to really look closer at what you are spending money on and where you could afford to save. Each day has a companion blog post and she gives you even more ideas on how to cut back in places you don’t even notice.

Anyone can look at where their money goes each month, but few break it down into small enough pieces that they feel they can really make a difference. I took her challenge to see just how effective her approach is and how easy it is to do for someone who has not looked at their budget before.

Day One- Figure out how to log into your bank account.

Yes, the first task really is that simple! Whether your bank has an app or if they just have an online banking option, the first task is to log in. That’s it!

I was just talking to a friend recently and she was talking about how she has a hard time keeping track of her 15 year-old daughter’s babysitting money account. I asked, “well, why can’t she do it?” She can DO that? I asked which bank she was a part of and it turns out that not only can her daughter put the app on her phone, her mom could add the app and be able to transfer money into her account with the push of a button.

Mind. Blown.

If your bank does not have an app but logging into the online deal is too time consuming or annoying, you could add an app like Mint and attach your accounts straight to a budgeting program!

Day one, check.

Day Two- What is your monthly take home pay?

Again, you may already know this. If not, look at your paychecks from last month, that’s what it is. Some people take advantage of direct deposit, so they don’t necessarily see the physical check or know the exact amount each pay period, but now you have your fancy online banking/app to let you look instantly!

If you do not have a set income each month, you can take the average of the last couple of months to help you get a better idea. That number is what you will budget with and any income over that amount will be gravy!

Day two, check.

Day Three- Do something generous today!

Yep, really! Do something easy, like pay for the person behind you at Caribou, or get creative! There are tons of ideas to be found for paying it forward. I tipped my server overly-well and in cash, this one is tricky because some places use computer systems that will not allow credit card tips to go through if it is over a certain percentage of the bill, this is to protect the customer from accidentally being overcharged. If you pay in cash the server will not only get to keep it, but will only be taxed on what the bill would have lent to a normal sized tip. As a former server, I know how amazing it is when someone makes you feel like you did a great job.

Day three, check!

Day Four- Put $20 in an envelope and hide it out of sight.

This one will make for a nice surprise later in the challenge (or if you totally lose it, then a really nice surprise way later when you forget what it’s from 😛 )

Day Four- check.

Day Five- Write down your monthly entertainment expenses.

This could be coffee, a gym membership, movies, cable, streaming services, date nights, etc. Handsome Man and I do not belong to a gym or have cable, and I don’t really drink coffee, so the only places we really spent money on entertainment was in our streaming netflix and going out to movies. This made Day Six a little tricky…

Day five, check.

Day Six- Figure out where you could cut back in entertainment expenses.

See what I mean? If you are someone who goes out to get a coffee everyday, it is easy to say you’ll only get coffee 3 times a week, or start making it at home. But with Netflix, it is $10 a month, which we could cut back by getting rid of it completely but it certainly isn’t breaking the bank. Going out to movies, you can definitely cut back the expense of that by going to see the movies once they hit the cheap theaters, or skipping the popcorn. Handsome Man and I love movies and even though it is sometimes hard to wait that long, RedBox is also a great alternative when they won’t be coming to netflix anytime soon.

Day six, check.

Day Seven- Save on gas! How much do you think you spent last month on gas? How much did you actually spend?

This is it for the first week! I guessed that I spent $100 or so, maybe more because I went down to Illinois for a work thingy. Using my handy-dandy banking app, I was able to count up that I actually spent $211.67. Which was obviously a lot more than I anticipated, but made sense with my unusual travel. Looking at previous months I was a lot closer to my original guess. Saving on gas can be easier than you think too, a lot of stations have reward systems you can use. Holiday stations participate in Cub Rewards, where when you shop at Cub Foods, you save money on gas with a little rewards card. Super America has a rewards card that can save you $0.03- $0.05 per gallon when you swipe it, and there are a lot of other programs at local stores as well. Professional sports teams will sometimes have discounts when you see their games, for example you will receive a few cents off of gas for every run the Twins get, or for every free-throw the TimberWolves make (it works out better if your local teams are good…). There are also apps out there like GasBuddy that show you which stations have the lowest prices near you. It may seem insignificant but it adds up!

Day seven, check, check, check!

That is it for the first week of the 14 Day Money Finder Challenge, although I don’t have all of the “normal” expenses she talks about it was still easy for me to see where I can make small changes to see big improvements.

Thanks for following along today Lovely Savers, I will be back next week with the last seven days, and on Thursday with the weekly recipe. I’d love to hear what you think of this challenge and if you are participating too, comment below!

Sugar and Savings,

Taylor

XOXO