Hello Lovely Savers!

In previous posts I’ve talked about my savings jar, which is quite literally a giant jar that I keep next to my bed. I throw all of my loose change and bills in this jar, and after a few months take it into the bank to put into my savings account. When I was waiting tables, the cash that I didn’t set aside for my envelope system, all went into the jar. This would add up really quickly, which was really great and motivating to be able to see the jar filling up. Due to some “life happening” the savings had been pretty depleted by the end of 2015.

After graduating, I took an unpaid internship with a local theater, which I didn’t plan to stay in for long but couldn’t find a full time job to save my life. I was working part-time for my favorite theater, The Southern Theater in Minneapolis, but that wasn’t really paying the bills. Aside from “the bills” I wanted to pay a significant amount on my student loans each month, which left nothing for saving. Eventually my internship turned into a full-time temporary position, which really helped me start putting some money away again. When my car started to die, I was able to sell it to a family member for cheap, and buy a great used car for cash!

Then, of course, more “life happened” and my savings was practically gone AGAIN. I understand that this is why we save, “life happens” and the savings is there to protect us. However, I’m pretty obsessed with watching my bank account, and I like to have a full savings account. So around November, I was on Pinterest, looking up different savings plans and seeing how I could put away my very small paycheck to where I wanted it to go.

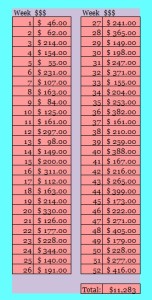

The plans I found were great! Very easy, very doable, and very small results over the course of a year… Wasn’t good enough for me. So I made up my own, a very doable, very steady way to save over the 52 weeks and in the end I would come out with over $11,000.00!

This plan worked for several months, but I wasn’t making my progress toward my loans like I wanted. I reevaluated where my money was going, according to Dave Ramsey you are only supposed to keep $1,000 in your savings account and the rest goes to your debt pay-off. That sounded awful! What if I needed it? What if there was an emergency?! It was true that I couldn’t think of an emergency that would come up that would be likely over $1,000…. but still! What if someone kidnapped my adorable German Shepherd, Fern, and demanded I leave the ransom in a duffel bag in the park under this tree marked by a temporary tattoo and they were demanding $1,001?!?!?! Well then I thought about it and figured I could find an extra dollar in the couch cushions and borrow a duffel bag from my parents. (Why do parents always have a million duffel bags?)

So I continued on with my savings plan, but instead of putting the money into my savings account, I put it directly toward my smallest loan and celebrate as I watch it get smaller and smaller!

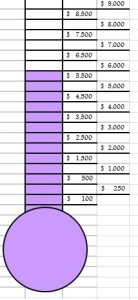

I am a very visual person, so I also made up charts like this to fill in as I pay off my debts. As it gets closer to the top, I know I am moving towards being debt-free!

I know this plan is a HUGE commitment. I am ready to tackle my debts and I’ve been able to work out being able to put this much away each month, I am also lucky enough to be living at home while doing this and therefore have the freedom to put that much toward my goals. However, there are much smaller and slightly easier to chew plans on pinterest. These calculations were based on a combination of several of those and my own finances.

Coming up, I’ll be posting how I budget each month, on a variable income. I’ll also be keeping you all posted on how this plan is working!

Sugar and Savings,

xoxo Taylor