Hello friends!

I must apologize for my absence, I was in the process of opening my latest show I directed. It was a Murder Mystery, but the real mystery was whether or not I’d make it through the opening while dealing with some… let’s say Diva-ish… personalities. On top of all the drama that comes with- well, drama- I got the flu! Which is no fun to say the least!

We made it through the opening night and my cast was spectacular!

But I am back now, and ready for some more Sugar and Savings. Many people have been asking how I created my budgeting system. I did, and continue to, use Mint for tracking my bank activity and also my credit score. However, I felt that Mint never gave me enough options for how to really look at an overview of my month. Everyone looks at information differently and of all the programs I tried, I found Mint to be the easiest to navigate, easiest to categorize spending, and it syncs with your bank information for free! As a Dave Ramsey fan, I did try Everydollar.com but I found it hard to use, it was difficult to figure out how to add categories, and it does not sync with your bank information for free. You have to pay. Which I question, because if Mint can do it for free… why can’t Everydollar? But I digress.

Even though I keep Mint for double checking purposes, I more regularly use my bank’s app and my own personal budget pages I created on Google Drive. By making my own, I can customize my categories, how much I may spend on something in a given month, and what my savings goals are for that month.

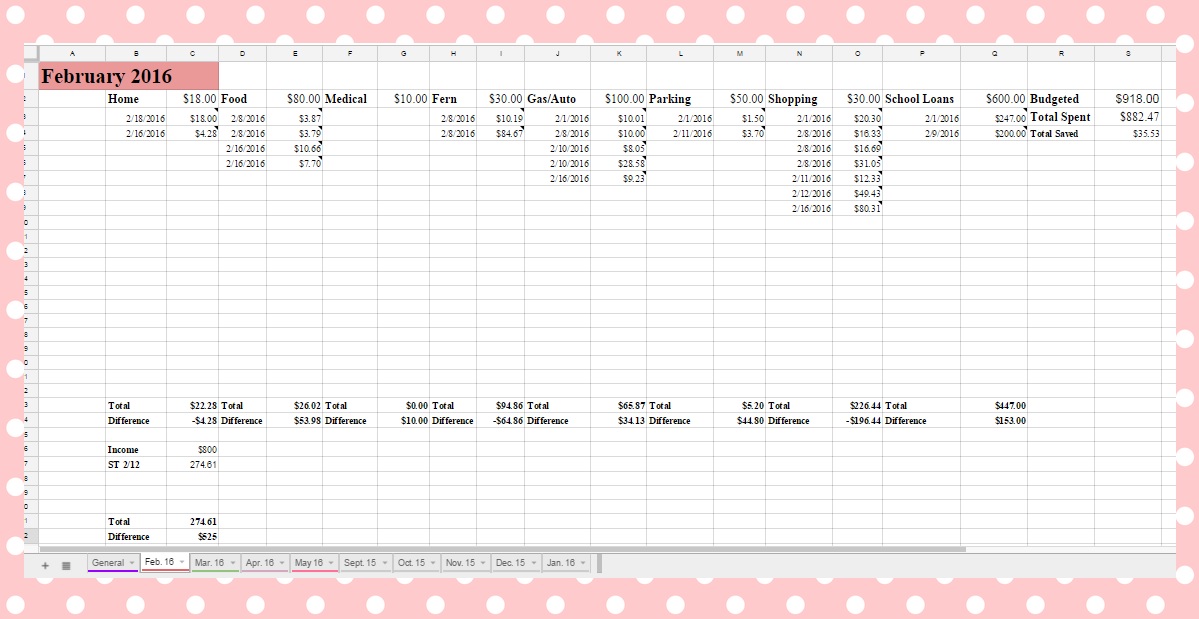

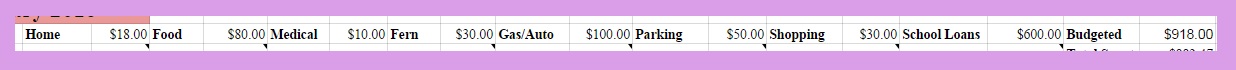

Here is what my overview sheet looks like: It isn’t a full picture of what I might spend money on in a given month but it serves as a basic starting point for each month.

This is what each month starts to look like: I write my categories, what I budget for spending in that category, and make my little total calculations.

My categories are Home (home supplies: toilet paper, soap, toiletries, etc.), Food (groceries, restaurants, coffee shops, etc.), Medical (prescriptions, etc.), Fern (my puppy! Her food, treats, vet trips, grooming, etc.), Gas/Auto (Gas, car maintenance), Parking (I have to pay for parking at work, so this one gets it’s own category), Shopping (my downfall…), School Loans.

I like to break it down by categories because I have a variable income, and this allows me to see before the month starts whether or not I need to make changes.

Then I use my bank’s app to keep track of any spending I do, then I put it into it’s category, and list it by date. I also make a note on each purchase so I know where it was and what it was for. So if I over spent in the shopping category (which… is often…) then I can see what I was spending money on. One month I could spend a lot on gifts for others, and some months I fall into my retail therapy clothes shopping habit…

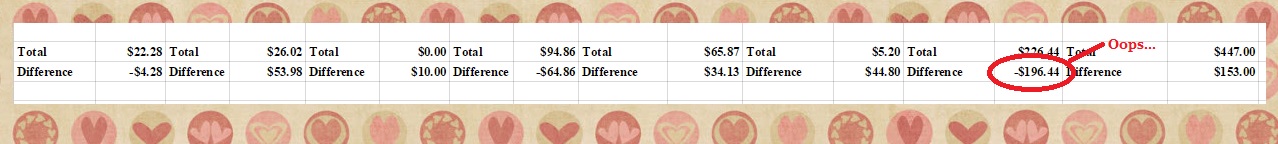

I make totals at the bottom so I can see the whole picture and see how much I have left in each category.

Also, when my income is so varied, I keep track of that right next to everything. If I’m making less than I thought, then I know I should be conservative in my spending.

So that’s what I do! I really like my budgeting sheets, it took me a long time to get them to be just right. Everybody is bound to need something slightly different, so this is just an option when you find you don’t quite fit the mold of online systems.

Thanks so much for checking in with Sugar and Savings! Coming up soon I will be going over “Grocery Shopping for One” and date night ideas for cheap!

Sugar and Savings,

Taylor

xoxo