Hello Lovely Savers! This week I wanted to talk about a potentially (key word here) great way to save money… having your groceries delivered!

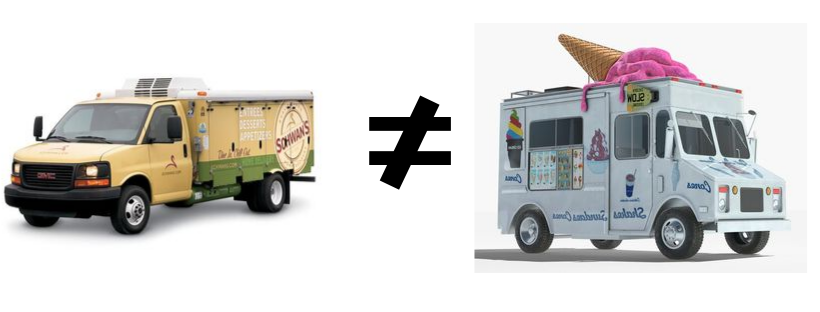

Growing up, in our neighborhood, we had the Schwan’s Man. A beige boxy truck with a swan for a logo, that would stop at certain houses and deliver groceries. I was convinced that it was ACTUALLY an ice cream truck and that my mother was lying to me so that I was not able to have those awesome little ice cream cups with the pull off lid. I knew those came from Schwan’s but had little to no understanding of why you couldn’t go up to the truck to buy some, you had to order them. And I had little to no understanding of why my mother did not order some then! Was she TRYING to deprive me?

Then when I was old enough to figure out it really was a grocery deliver service (and that you can buy those ice cream cups at regular grocery stores too, she was just choosing to NOT for some reason) I did not understand why anyone needed their groceries delivered. Didn’t they know Cub was down the street? Did they really pay someone to bring them their food? Were they just really lazy? It was baffling to me.

Then even later when I had to do my own grocery shopping, and I was already more frugal than is probably good for me, I could never imagine spending money on a delivery service. Surely, it was crazy expensive right?

One day I heard an ad on the radio (see? Sometimes those things are good to listen to!). It was for this generation’s Schwan’s Man- Coborn’s Delivers. If you signed up for Coborn’s with a code from the radio station, your first 3 month’s of delivery were free and you got like $10 off your first order or something. Well, for the sake of this blog of course, I was willing to try this mysterious delivery if I didn’t have to pay delivery fees AND I saved $10.

So I logged in and signed up and had groceries delivered for the first time. I wouldn’t say that it saved me any time- as I had to learn to navigate the site and find the foods that I liked, but it definitely didn’t take me more time that it would have taken to actually go to the store. Then on the day I selected, I had big green plastic bins delivered to my door. They were packed with cooler ice packs and after I unpacked my food I just logged on again to schedule a bin pick up for free.

It was pretty slick and, at least with Coborn’s, it really wasn’t any more expensive than a regular trip would be. Even if I had paid delivery fees, which were only $5 usually, I could see the benefit of having this done every now and then. And I did use it again when I was on rest after surgery in July!

Now- why did I say “potentially” a great way to save money then? If everything was so comparable?

Because I am a pro grocery shopper. I am so particular that I know what food costs and what I am willing to pay for certain items. I’ve been doing this blog a long time, I’ve been a stickler for saving money for even longer. I go to the grocery store with a list every single time, but even I know the dangers of grocery shopping while hungry! Impulse buys? Candy aisles? Seasonal decor (why is this in a grocery store?!)?

Everything in that store is designed to be tempting. So maybe, if you are particularly susceptible to impulse shopping, having to search for specific items on your list without those other aisles could save you a chunk of change.

And what about the time? Once you get good at using the website, it does go a lot faster. AND you don’t have to drive to the store, find a parking space, walk through every aisle because they renovated AGAIN and moved all of your favorite stuff, and wait in the check out line. Someone has to tell the stores that they don’t need 27 check out lines if they are only ever going to open 4 of them at a time. THEN going back home, unloading the car, and putting it all away. I only TYPED this and I feel like I need a nap.

You know yourself better than anyone. Would spending $5 on delivery be worth saving the time and skipping the tempting impulse buying? For me it was. And sure, there are other pros and cons to a grocery delivery service, but I write a personal finance blog- not a grocery deliver critique forum. It was worth the $5 delivery to me (and if you keep your ears tuned in during commercials- possibly free delivery!) and it might be worth it to you as well.

A word of caution- I have only used one delivery service. I have HEARD that some services may charge more for their food to offset their costs. 1. That makes sense. 2. Be conscious of what items usually cost and whether or paying a little more on them would be worth it. Again, you know yourself better than anyone. If you fall victim to impulse shopping and spend around $10 extra on those impulse items, and the delivery service fees are $5 and they charge $2 more on a particular item, maybe it would still be worth it for you.

As always, thank you so much for all of your support, Lovely Savers! I love sharing my tips and tricks for money and how to deal with everything in between. Please join the Facebook Group: Sugar and Savings- Budgets and Saving Money to be a part of our community of other lovely savers. We share our thoughts, and plans with money, and we celebrate each other’s wins! And each month I go live to answer YOUR questions about personal finance!

Until next time, wishing you all Sugar and Savings,