So anyone who knows me, knows that I am slightly obsessed with my personal finance (She writes on her personal finance blog). I also happen to be pretty obsessed with Dave Ramsey, he is a personal finance- get out of debt- live debt free guru! I listen to his podcast pretty regularly while at work, and I was even featured on his radio show back in September! I’ll talk about that more in another post I’m sure.

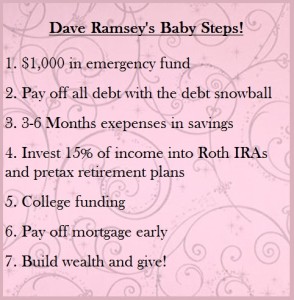

I don’t agree with all of Mr. Ramsey’s ideas and opinions, but I started listening to him after I saw a pin on Pinterest listing his “Baby Steps” to getting out of debt. It’s a great tool he focuses on in his own teachings, and I loved the idea!

He also tells his followers to cut up their credit cards and live entirely through cash transactions.

Which is not really possible. In fact, let’s just say it, it’s not!

But he doesn’t mean, you should only ever carry cash, and shouldn’t use debit cards- YOU HAVE TO. It is not realistic to pay bills via cash, you have to pay them online, or at the very least by check. What he means, by cash, is no credit! You can only pay for things that you have the money to pay for at the time you want to pay for them. New car? No loans. Going out to dinner? You better have money in the bank for that. This is obviously a very simple way of looking at a large problem, but it is designed this way so that people who HAVE issues with credit cards can kick the habit and get themselves out of debt without creating more debt in the process.

He has a cash envelope system for the things you CAN pay cash for. Each month you take out the money you have budgeted for specific things: Groceries, Gas, Pets, etc. Once the money in the envelope is out- it’s out! No more of whatever that was! It really helps to show where your money is going and helps you not make impulse buys. I even followed this plan while I was in college, not perfectly mind you, but it was easier because I was waiting tables and had cash on hand all the time. My paychecks were put in the bank, I used a certain amount of budgeted cash tips to put in my envelopes, and the rest went into my savings jar!

However when I graduated, I promised myself I would try to hold off on serving, and find a job in my desired field. It’s harder to use a cash system when you use plastic to pay for everything!

Thus, MY envelope system was born!

I’ve been using my system pretty successfully for the last month. Instead of cash, I use printed monopolyish-cards that have cash values on them and put them in my designated areas.

Once the section is empty, I’m done for the month!

I also have sections for my check card, my credit card, and my business card. When I use my check card to pay for groceries, I take the cards out of the groceries section and put them into my check card section, likewise for gas on my credit card and so on. If I use my check card to buy something for my business (if/when I leave the right card at home on accident 😛 ) then I put the cards into that section so I know to transfer reimbursement funds later.

This has been a pretty important group of sections, for most banks these days, they require you use your cards at least ten times each per month to avoid fees! Is that ridiculous? YES. And that’s why using all cash wouldn’t work, you would be charged fees for not using your cards. To make this system work for me, I try to remember to move the cards into the right areas as soon as I make a purchase, but I’m certainly not perfect and I do reconcile with my budgeting system when I go update that. I’ll have a post about my online budgeting spreadsheets soon!

This has been my envelope system, let me know if you also use a modified cash envelope system! I’ll make a post about all of your ideas as well!

Sugar and Savings,

xoxo Taylor

While I was in college, like most young adults going through our higher education system in this country, I racked up some serious debt. I tried not to; I didn’t have a credit card, I lived with a roommate in a cheap apartment close to school, went to a state school, I bought groceries way more often than I ate out, and I worked my butt off- I had a serving job for 40-45 hours a week, AND I GRADUATED EARLY. I was in college for exactly three and half semesters…. and I still owed $54,000.00 when I graduated.

While I was in college, like most young adults going through our higher education system in this country, I racked up some serious debt. I tried not to; I didn’t have a credit card, I lived with a roommate in a cheap apartment close to school, went to a state school, I bought groceries way more often than I ate out, and I worked my butt off- I had a serving job for 40-45 hours a week, AND I GRADUATED EARLY. I was in college for exactly three and half semesters…. and I still owed $54,000.00 when I graduated.