Hello Lovely Savers! I hope everyone is enjoying these first few days of Summer and the heat wave some of us have been experiencing in the Northland. June starts TOMORROW and for many that means the end of the school year is days away. Some families will be celebrating their brand new High School or College Graduate, and that means parties. And that means everyone they’ve ever maybe possibly met being invited, and that means a ton of invites for you to try to wrestle through, and decide what on earth you will give these kids you maybe possibly sort of know.

Never fear. I have a list for you.

Gift Guide for Graduates

1. Cash. This one is super easy, requires absolutely no knowledge of the student or what their future ambitions may be, and is always greatly appreciated. You buy a card, put a $20 inside (etiquette, their parents are going to give your kid the same thing eventually) and they get to pay for .05% of one single text book or a pizza for a late night study session!

2. Books. This gift is probably my favorite. When I graduated High School, one of my favorite teachers gave me a copy of A Little Princess and wrote me a note inside that I will cherish forever. Thanks Mrs. J! You can do a fiction novel, like that, for fun and sentiment, OR here are a few of my recommendations for a bit more practicality:

Of course I need to plug my own book, If I’m an Adult… Where is my Money?

This is my quick guide to money for aspiring adults. I cover all the basics of handling money as you enter into adulthood and walk you through starting a budget! You can purchase my kindle book here.

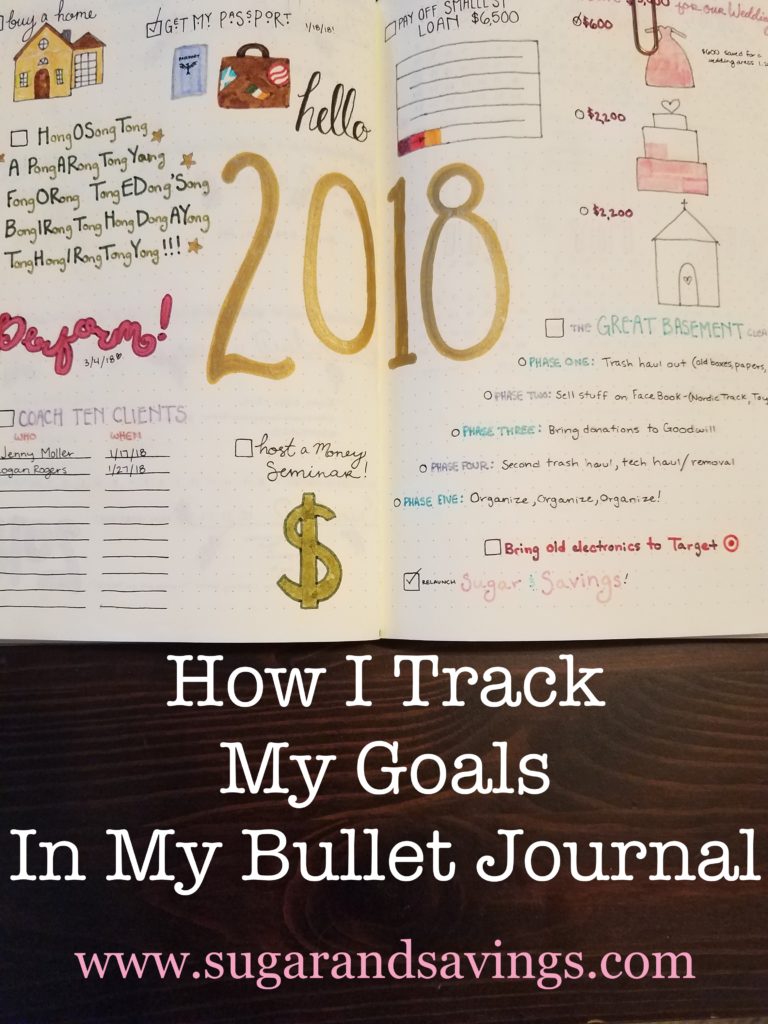

Adulting is one of MY FAVORITE BOOKS I’ve ever read, it is charming and funny and literally FULL of great tips, you can read my review and my top lessons learned from this book here. Dave Ramsey is one of my personal finance heroes, his daughter, Rachel Cruze is another and their team put together a guide to getting through college. One of the best things that ever happened to me at college was when I volunteered to man an information booth at some event and in return was gifted the Strengths Finder quiz where I learned what my top 5 strengths are (Thank you Stacy!)! This book is the guide to those strengths and how you can best utilize them through life and leadership. Realizing my strengths was life changing. Click on the pics above to order a copy for your grad on Amazon!*

3. A Care/Dorm Package. My sister is the actual best. She’s not even my real sister, but I will fight anyone who says she’s not my sister. For my graduation gift she put together a funny care package for me, complete with pedialyte and aspirin for the hangovers I never actually had. She gave me snacks and posters for my dorm, and put everything into a small pink garbage can for my new room. My mom then did a similar package for my little brother and it served him quite well! What does your grad need? Gift cards to Dominos? An extra large coffee mug for late night cram sessions? Or a super loud and annoying alarm clock, guaranteed to get them to those 8am classes! (Seriously though, why were all the most boring lectures at 8am?)

All of these gifts can be done in cost effective ways, which is great for everyone and every budget, but is especially good for those who have a half a million grad parties coming up in the next two months. What was your favorite gift you received for graduating? Comment below!

Don’t forget to sign up to my email list to get reminders when I post new ways to save you money! Also, I am now booking clients over on my Facebook page or else you can email me here at sugarandsavings@gmail.com. Work with me personally to get yourself on a budget that WORKS!

Until next time, wishing you all Sugar and Savings,

Taylor

* This post contains affiliate links. This just means that I may receive a small commission (at no cost to you) if you purchase something through the links above. You will never see me post a link to a product or service that I haven’t used myself and love! Thank you for supporting Sugar and Savings!

Spring is almost here, you may be planning for a spring break trip and want to be beach ready, or maybe you are just interested in cleaning up your eating habits. Whatever the reason, you probably have stumbled onto the Whole30 food craze and now you are motivated to try it.

Spring is almost here, you may be planning for a spring break trip and want to be beach ready, or maybe you are just interested in cleaning up your eating habits. Whatever the reason, you probably have stumbled onto the Whole30 food craze and now you are motivated to try it.

When working with people and their budgets, the first thing they notice is how much they spend eating out. “Oh my gosh,” they say, “I need to stop going out with my friends!”

When working with people and their budgets, the first thing they notice is how much they spend eating out. “Oh my gosh,” they say, “I need to stop going out with my friends!”