Hello Lovely Savers!

If you are like me, you need to revamp your schedule and life organization every few months. When I was younger my poor mother tried every planner system she could, trying to help me keep my school work in order… unfortunately for me (and my wallet) this led me to an obsession with getting new office supplies every time I drove by an OfficeMax. And if the Target dollar section had any office supplies, you can bet I HAD to have them. This is not budget friendly! In all honesty, this wouldn’t work for a lot of other reasons too, I would lose track of things trying to transfer information to the new system every time I switched.

That was until I discovered Bullet Journalling!

At first I thought Bullet Journalling would be just a creative way for me to have a calendar and schedule that I’d be able to change up to fit my needs as necessary, now I know I can put everything I would ever need in there!

Fun fact about me, I am no good at keeping my important stuff on my phone or a google calendar, I just don’t operate that way. I like to have everything written down, pen to paper. I know that is not the usual these days, so if you’re better at keeping an ongoing calendar and spreadsheet online, the more power to you! I now keep everything in my Leuchtturm1917 Notebook I got off of Amazon.

If you’d like to know more about Bullet Journaling itself, I recommend looking up BoHo Berry– she has a great Bullet Journal 101 section on her blog. Here, I am going to talk about keeping a budget specifically.

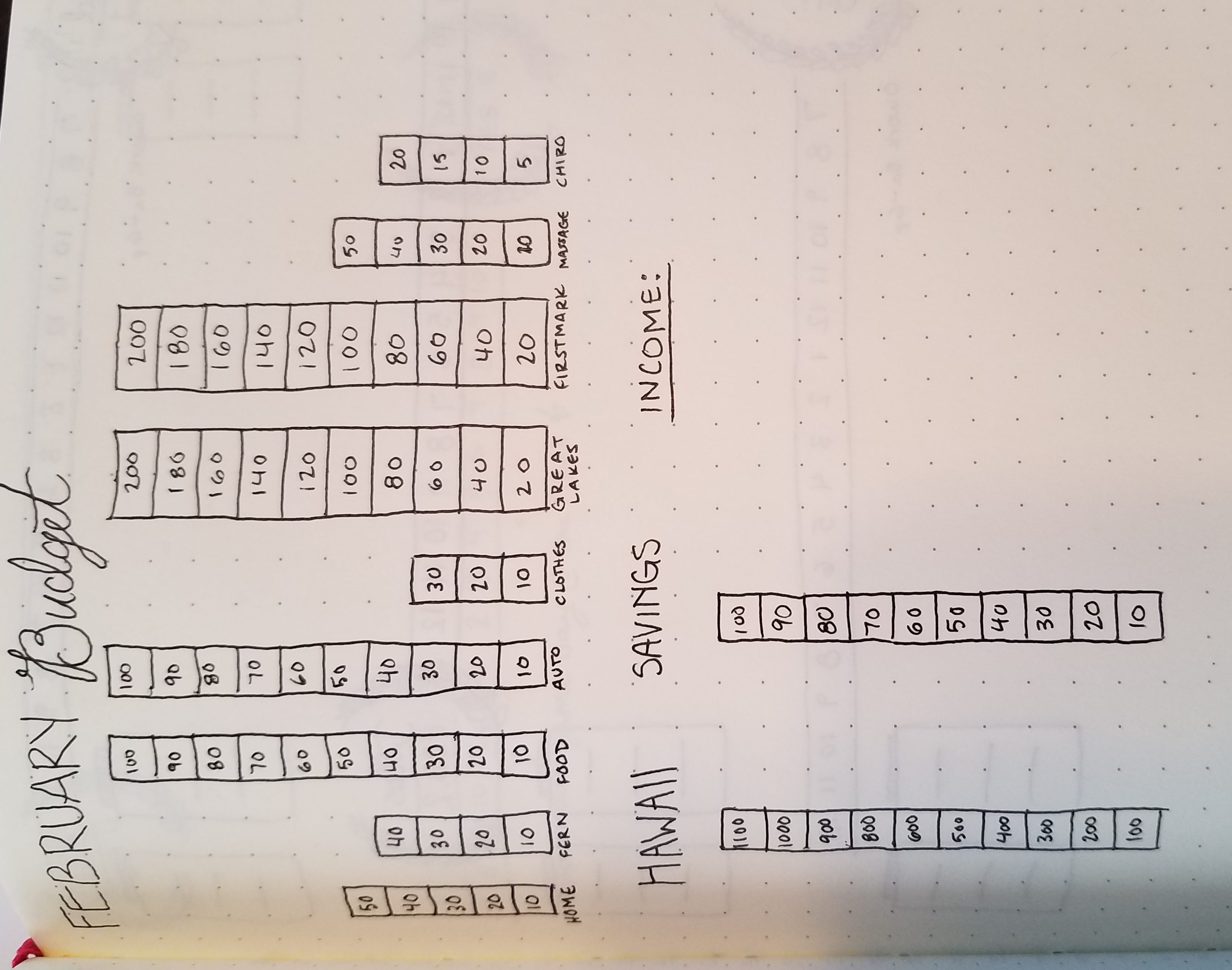

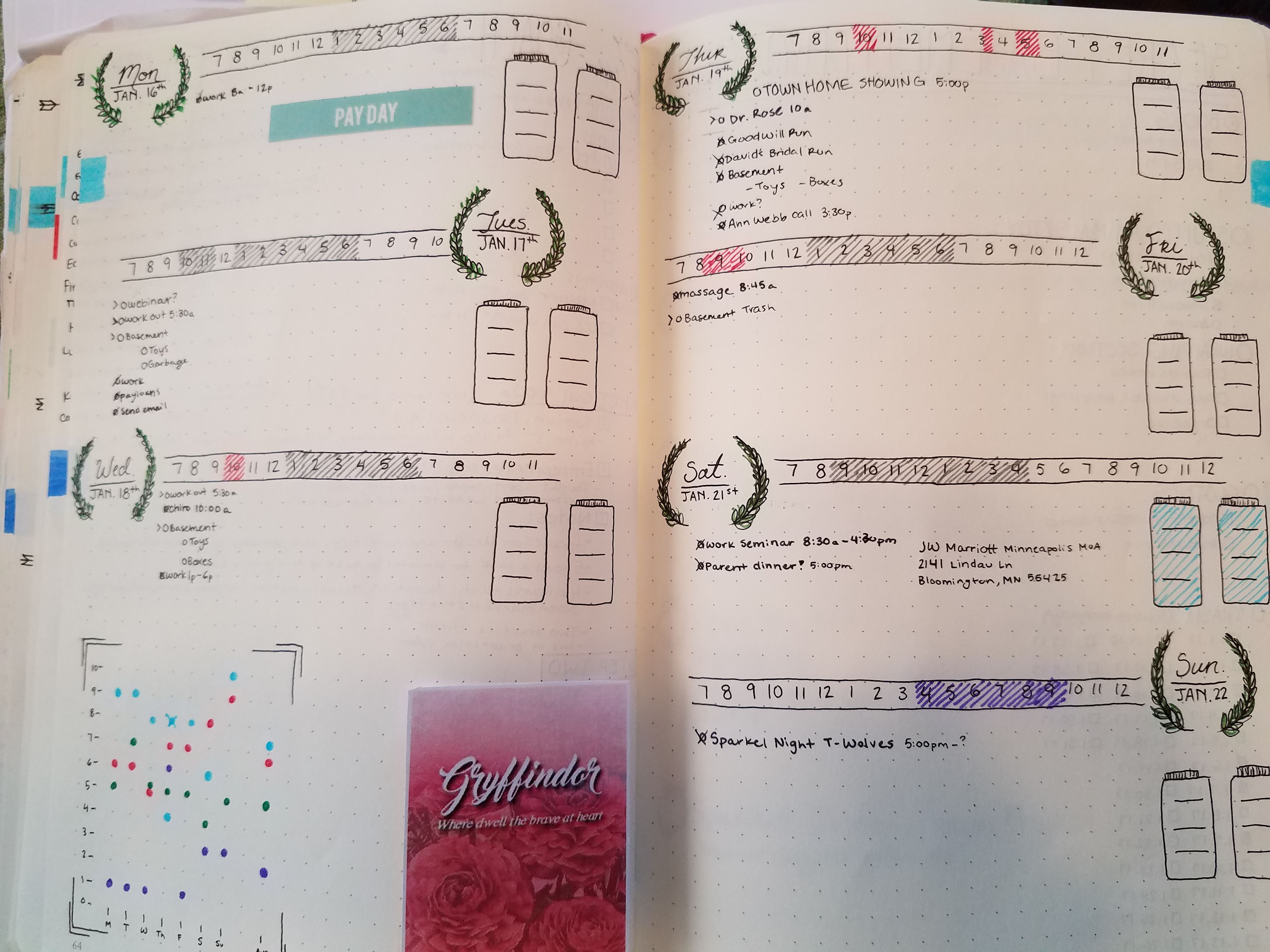

Here is my upcoming budget for February, I am a visual person and I like to color in the sections as I spend them. Right now this does not include my rent or utilities but that will change come March/April.

February Budget

Keeping my budget all in one place, in a notebook I carry everywhere, allows me to keep track of every dollar I spend. It is just too easy to nickel and dime yourself if you don’t!

I also make a point to write down my income every time I get paid (I work a lot of random jobs so it is nice to have it all in one place), and a place for what I’d like to save as well!

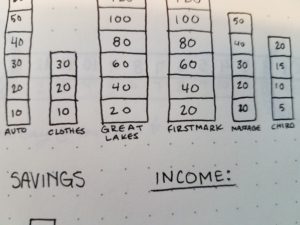

I mark the sections in increments I know they go in, for example, my Chiropractic appointments are $5 each time and I go once a week, vs. my gas is easier to keep track of $10 at a time.

I mark the sections in increments I know they go in, for example, my Chiropractic appointments are $5 each time and I go once a week, vs. my gas is easier to keep track of $10 at a time.

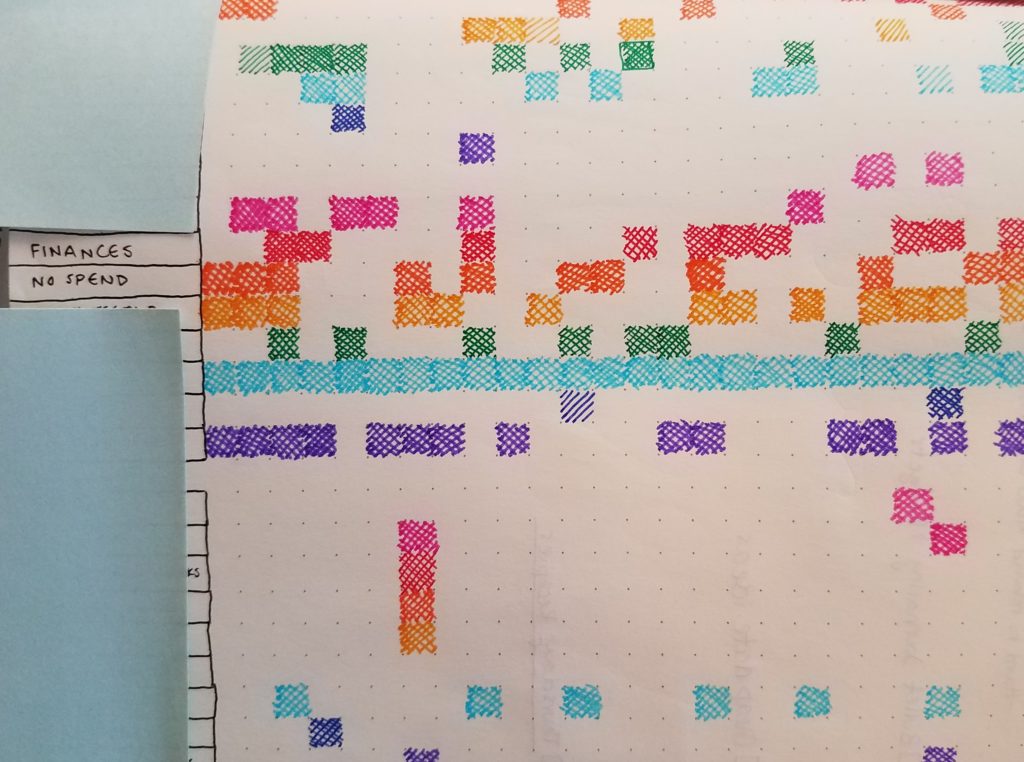

My bullet journal is also used as a habit tracker, I keep track of the habits I want to do/encourage myself to do daily, like checking in on my finances. I also keep a “No Spend” area in there that I get to mark off when I go a whole day without spending money!

Habit Tracker

The bullet journal system is great for keep tabs on your goals and the time you spend in certain areas of your life. Next month my goal is to spend more time on my personal development!

Color coded!!!

And of course, my planner. Which is the best part because you can add whatever you like! For planner ideas, I suggest BoHo Berry again, or pinterest!

Thanks for tuning in this week Lovely Savers, next week I will be working on the 14-Day money finder by Rachel Cruze and keeping you updated on how it works out the first week!

Sugar and Savings,

Taylor

XOXO