Hello Lovely Savers!

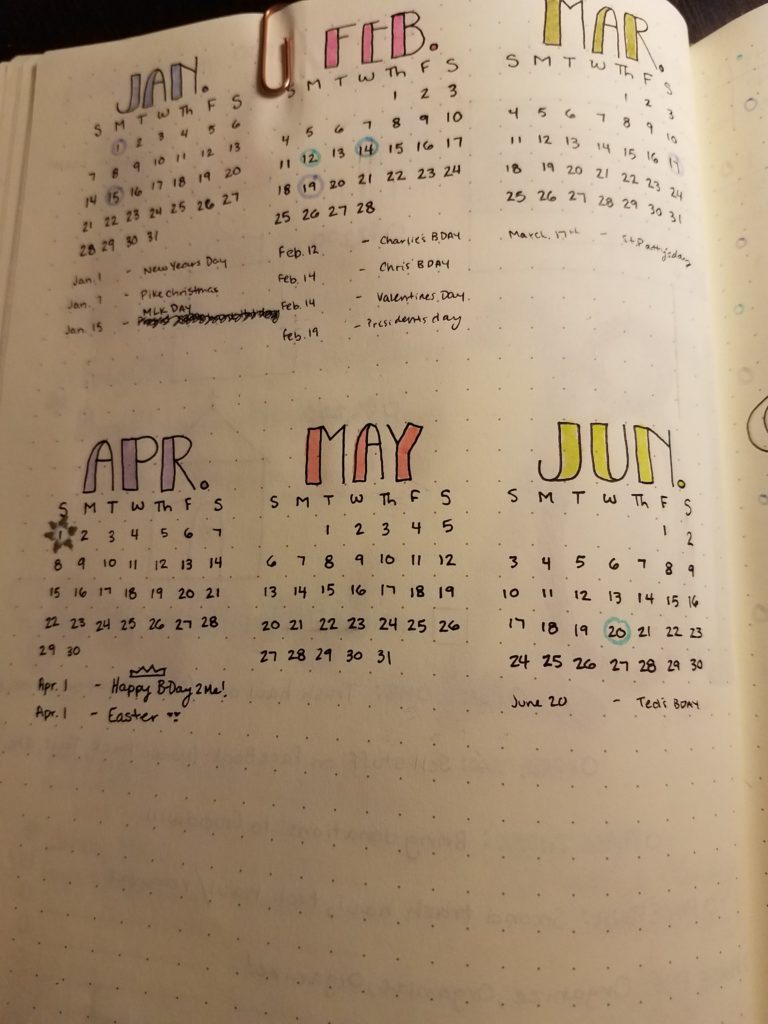

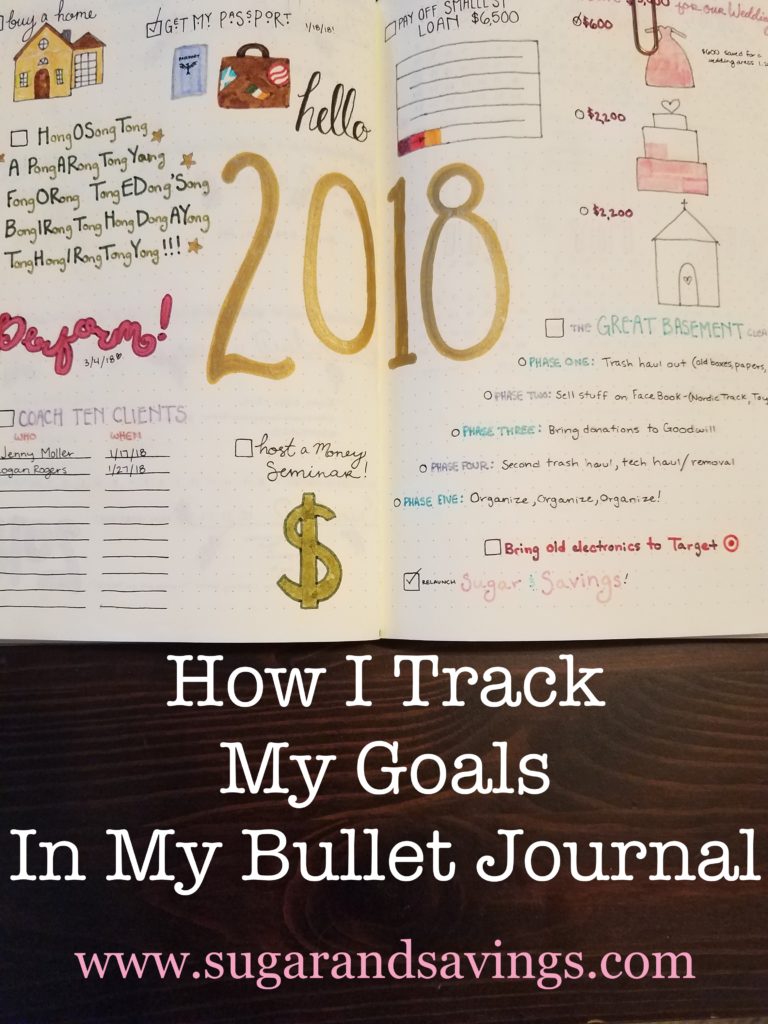

Today I thought I would share with you all how I keep track of my goals in my bullet journal. Previously I explained how I set goals and actually complete them, you can read about that here, but this is where I keep track of my progress!

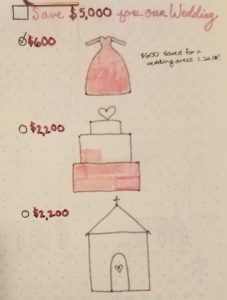

Here are a few goals I set for myself for the beginning of 2018:

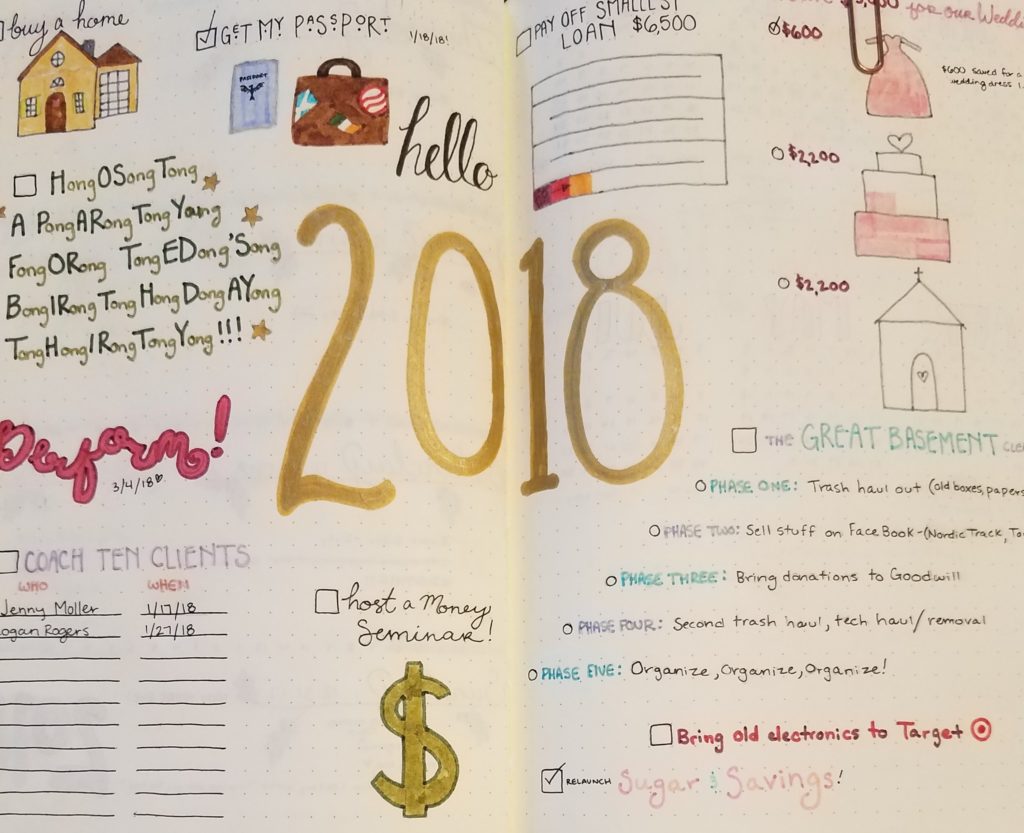

In 2018 I plan to -Buy a Home, -Get my Passport (check!), -Perform (check!), -Host a Money Seminar, -Pay off my Smallest Student Loan, – Save $5,000 for a wedding we are not actually planning yet, and – Relaunch Sugar and Savings (check!).

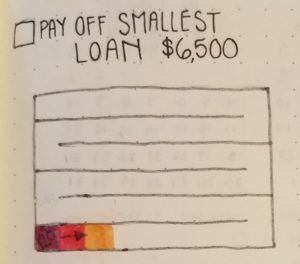

I am a visual person, so not only do I find that writing down my goals helps me keep track of them, but I like to be able to see my progress as I go. In the -Pay off my Smallest Student Loan area I made a little square maze that I can color in as I make additional payments toward that principle. I simply divided the total due by the payments I planned to make and then drew a box around that many squares. When I make a payment, I color another box in! (My colors of choice happen to be Tombow Dual Brush Markers, you can find a pack of them here! Tombow Dual Brush Pen Art Markers, Bright, 10-Pack)

As for the wedding I am not actually planning, I broke it down into smaller budgets. I decided that with a savings of $5,000 I would allocate $600 to a dress budget, $2,200 to catering budget, and $2,200 to a venue budget. Then I got a little creative, each box is worth $50 or $100 that I put away, and then I drew a design for each of those areas. The dress covered 12 squares and the others 22. As you can see, the dress is all colored in! With the savings plan that I have in place for this, I should have it all saved up by June. I’m sure I will share that savings plan with you all in another post soon.

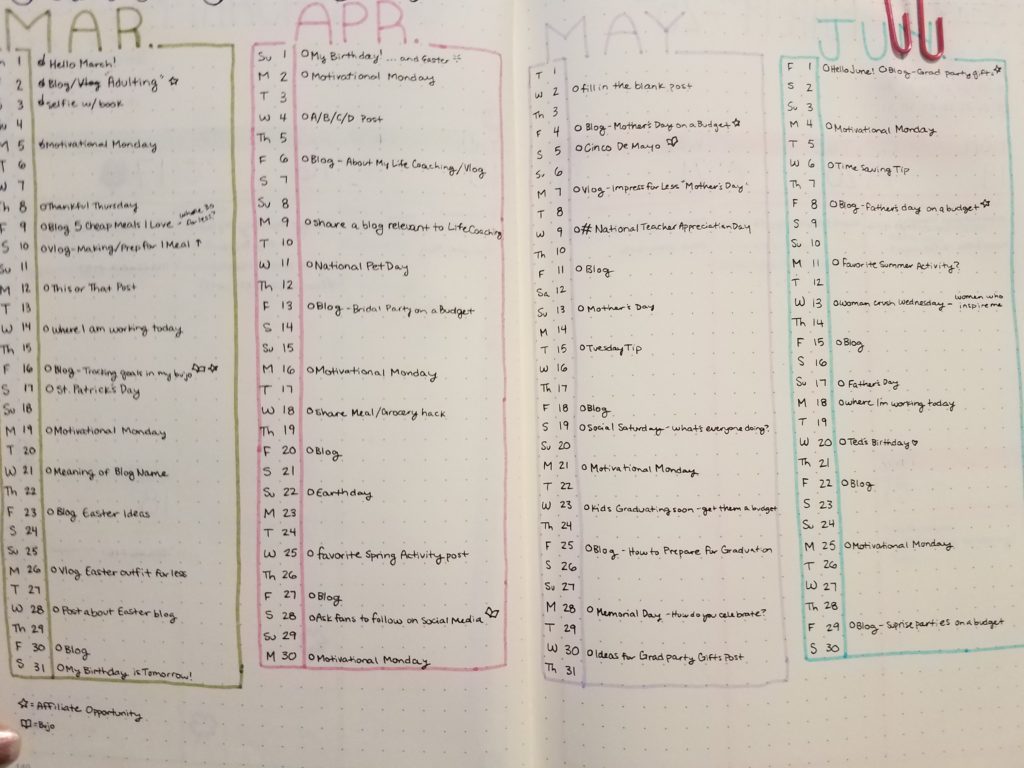

When relaunching Sugar and Savings, I decided I needed to keep track of social media better. While Handsome Man would tell you that I spend way too much time on Facebook, I am not one for actually posting anything. I used this monthly tracker below to plan out what I would be doing to promote the blog and my coaching services.

So there you are! Just a couple of ways I use my bullet journal to keep track of my goal progress. I firmly believe that you need to be able to see results to stick to your goals. How do you keep track of your goals? Comment below!

Until next time, wishing you all Sugar and Savings,

Taylor

* This post contains affiliate links. This just means that I may receive a small commission (at no cost to you) if you purchase something through the links above. You will never see me post a link to a product or service that I haven’t used myself and love! Thank you for supporting Sugar and Savings!

Spring is almost here, you may be planning for a spring break trip and want to be beach ready, or maybe you are just interested in cleaning up your eating habits. Whatever the reason, you probably have stumbled onto the Whole30 food craze and now you are motivated to try it.

Spring is almost here, you may be planning for a spring break trip and want to be beach ready, or maybe you are just interested in cleaning up your eating habits. Whatever the reason, you probably have stumbled onto the Whole30 food craze and now you are motivated to try it.

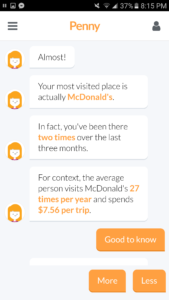

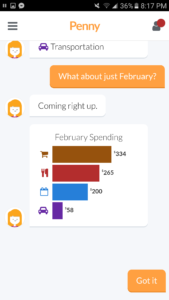

When working with people and their budgets, the first thing they notice is how much they spend eating out. “Oh my gosh,” they say, “I need to stop going out with my friends!”

When working with people and their budgets, the first thing they notice is how much they spend eating out. “Oh my gosh,” they say, “I need to stop going out with my friends!”

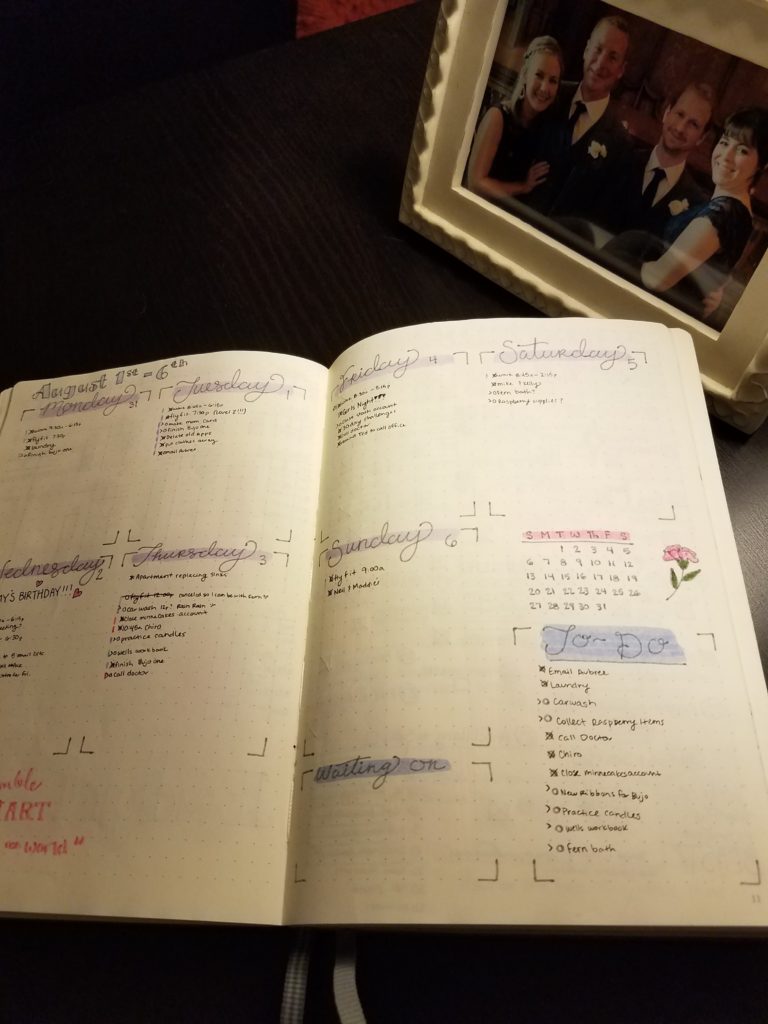

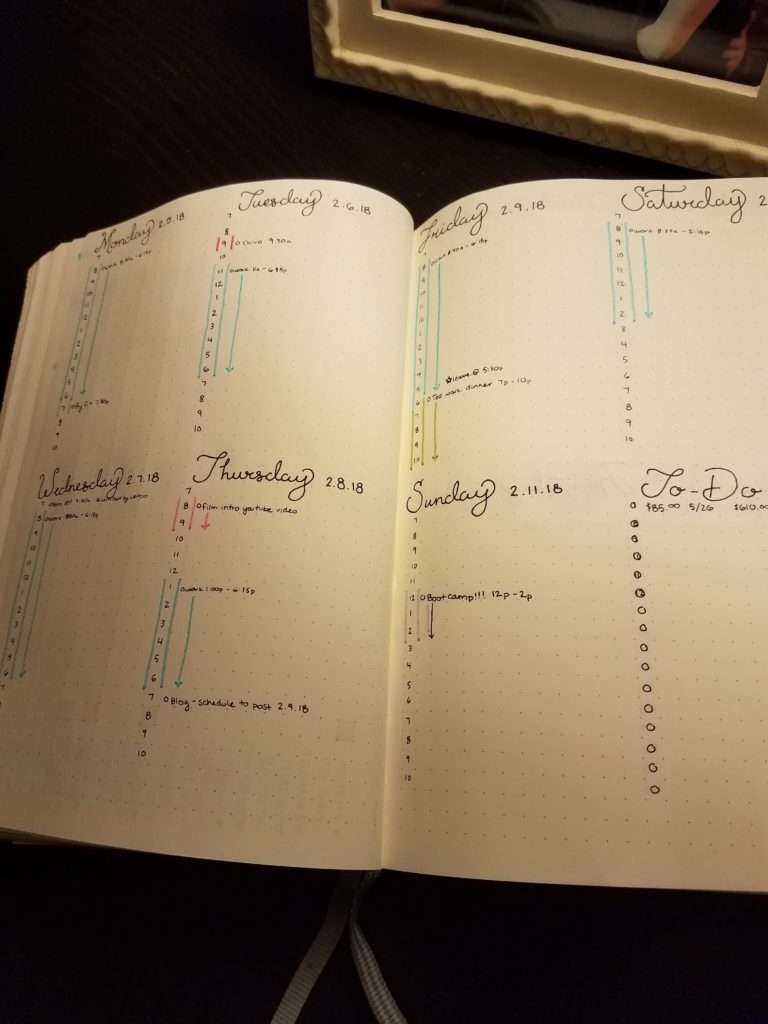

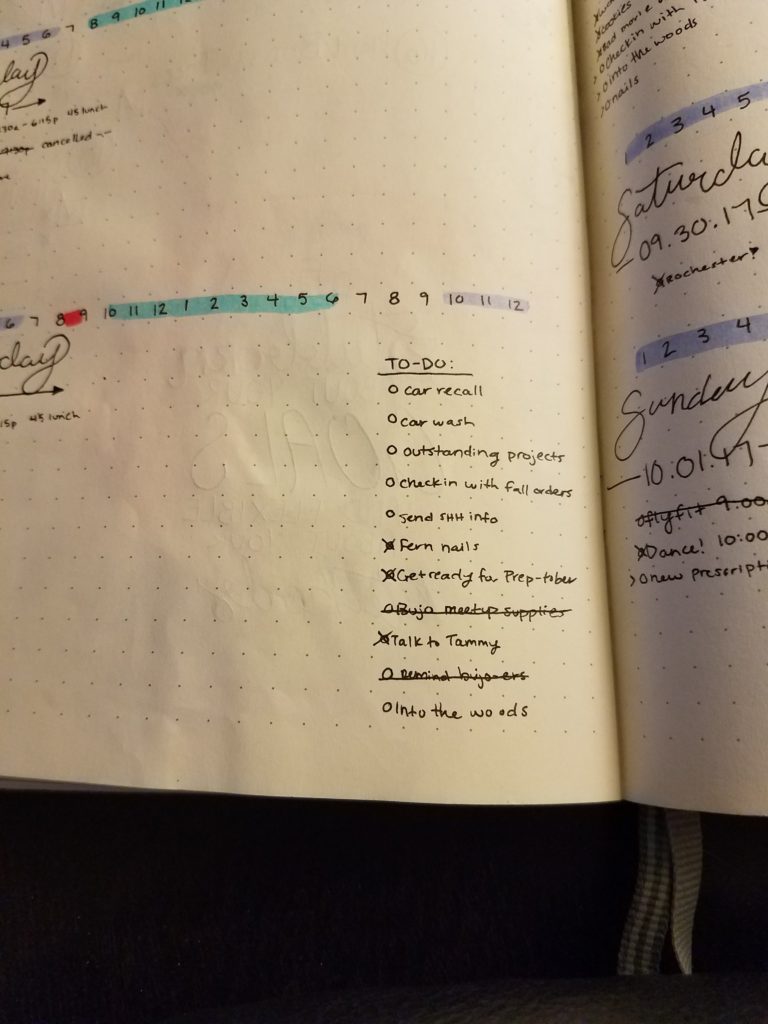

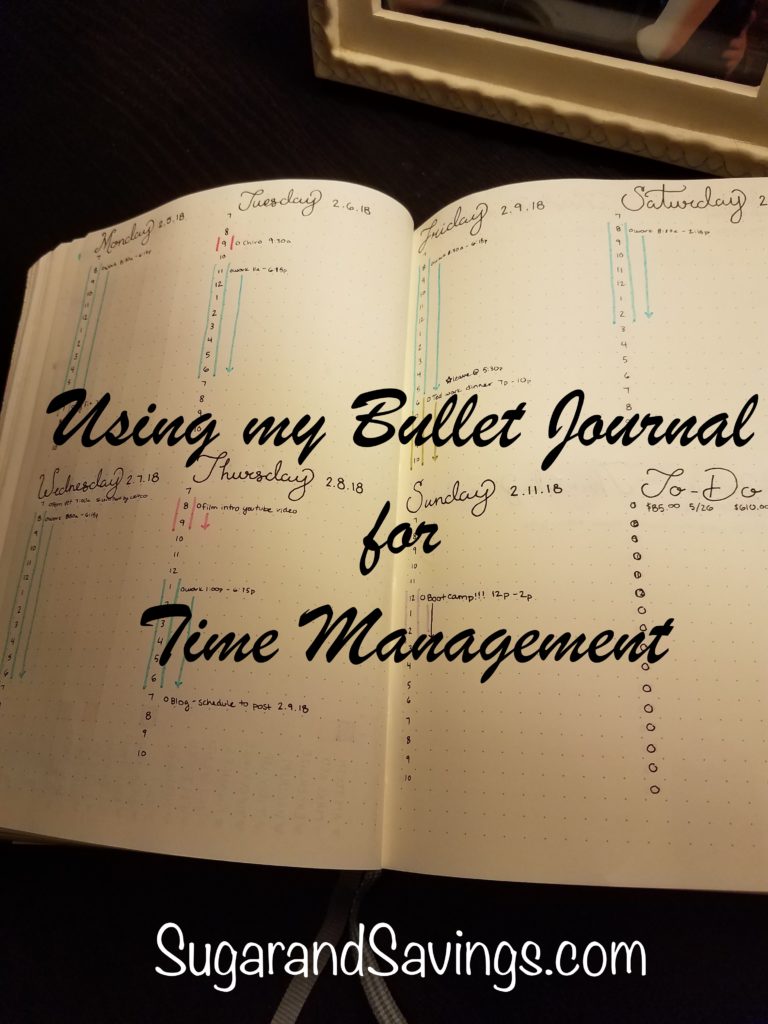

Growing up, my poor mother tried every organization/trapper keeper/planner system to try to help me keep track of my life. Everything worked for a bit, maybe a couple of weeks at the most, but eventually I would lose motivation and stop using them. Fast forward to my college years, trying on my own (in vain, mostly), to find a system I could keep up with. Many, many, planners later and I still would double book myself and be scrambling at the end to make sure my assignments were being turning in.

Growing up, my poor mother tried every organization/trapper keeper/planner system to try to help me keep track of my life. Everything worked for a bit, maybe a couple of weeks at the most, but eventually I would lose motivation and stop using them. Fast forward to my college years, trying on my own (in vain, mostly), to find a system I could keep up with. Many, many, planners later and I still would double book myself and be scrambling at the end to make sure my assignments were being turning in.