Hello Lovely Savers!

The blog post is a little late today, my only coworker has been out for the last few weeks so I’ve been busy, busy, trying to keep up. Silver lining, we’ll have a nice over-time padded savings account for our move next month! Without any further ado, let’s get into today’s post.

Today we are starting a short series on online financial tracking apps/websites. The first app we are looking at is one I had never tried before working through it for this blog, Penny. Penny is a relatively new app from the company Friendly Finances, Inc. The app is supposed to be able to track your spending, income, and bills. All while delivering you the information like a text chat with your new best friend, Penny!

Let’s start with the beginning, super cute hello and sign up!

Ok, so far, so easy, then we get to see how exactly this “texting” thing is going to work.

Evidently, you don’t get to personalize your responses to her, but it’s straightforward and I see where this is going.

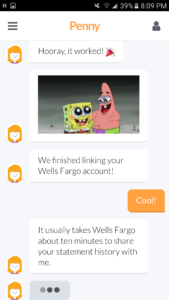

Then you will enter which bank accounts you’d like to connect to, I was even able to attach my student loan accounts. AND she sends you cute gifs to emphasize how she’s feeling!

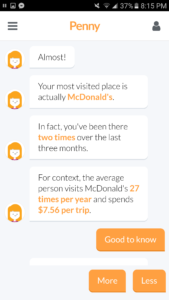

She asks you to answer quizzes, like “where is your favorite fast food place?” This was not entirely applicable to me because I rarely eat fast food and if I stop somewhere it is for fries. However, she decided my favorite fast food place is McDonalds based on that I was there two times in the last three months. And she gave me some fun facts about how terribly the average person eats.

Then things went a little wonky. For instance, when I paid taxes for my bakery, she marked that as a food transaction. Understandable mistake, but it didn’t end there.

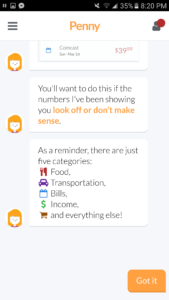

She only breaks things down into five categories. Food, Transportation, Bills, Income, and everything else… which is not very specific. Simple for those who like it that way, not my personal favorite. You can also have her ignore certain transactions, like transferring money between accounts, so it doesn’t mess up your tracking. When I went in to look more closely at how she was breaking things down, she was ignoring a lot of them or marking them “everything else” when it should have been falling under transportation for a gas stop. She apparently learns from what you change them to, but she is not very intuitive at the beginning and ignoring expenses could be dangerous for careful trackers.

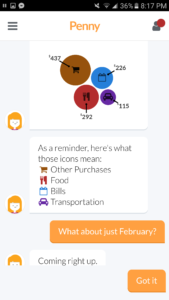

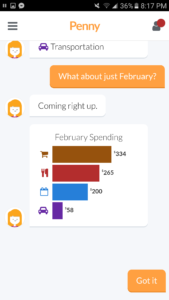

The five categories she does offer, are able to be viewed in different ways which make them easy to read, but again, a little too simple. It is cool to see the different graphs and visuals, but when things are so general it is easy to nickel and dime yourself into trouble.

The five categories she does offer, are able to be viewed in different ways which make them easy to read, but again, a little too simple. It is cool to see the different graphs and visuals, but when things are so general it is easy to nickel and dime yourself into trouble.

As a details person, Penny might not be the right app for me, but I can definitely see her charm! If you really spent the time to go through all of the charges and try to teach her what you want her to track and which category you want it in, Penny might work for you! Otherwise, I personally will be waiting to use it again, at least until the company adds a bit more to its features.

That charm though.

If you’d like to download Penny you can find her on the Google Play app or the Apple store.

Next week I will look closely into Mint, an app that I’ve used off and on for a few years. Comment below which apps you use or which you’d like me to do a review on!

Sugar and Savings,

Taylor

XOXO