Last week we started the first half of Rachel Cruze’s 14-Day Money Finder Challenge. You can read all about the first seven days here. If you’d like to join Rachel, and receive her emails and companion blog posts, you can sign up on her website here!

Today I will be going over the second half of the challenge and what I did with the days. I will also give out some ideas for how you can save even more on some of your “normal” expenses.

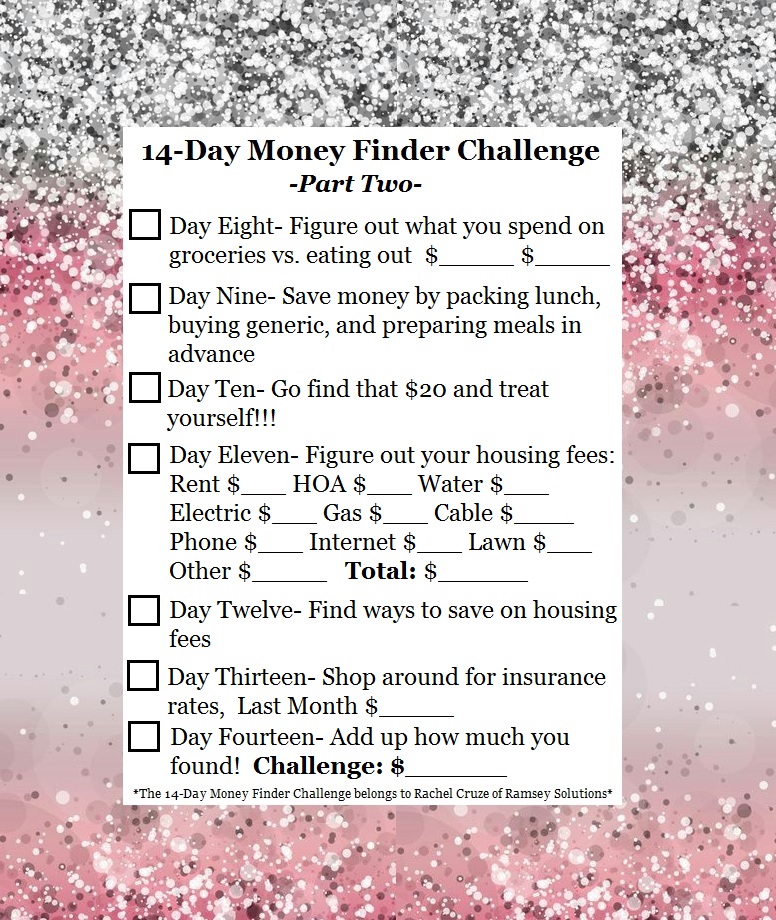

Day Eight- Figure out what you spend on groceries vs. eating out

By now we are all experts at working on our online banking site or app, so we’ll just log in and take a peek at where our money went before it made it into our bellies. For me, Handsome Man and I are living seperately right now so our grocery buying habits and eating out habits are a bit out of whack. Last month I spent $116.30 on groceries and $102.85 eating out. When deciding which counted as groceries or eating out, I counted anything bought at the grocery store as groceries (even if it was a snack or whatever) and everything that I got at a quick gas-station stop or restaurant was “eating out”. Working right next to a gas station has been dangerous for me.

Day eight, check.

Day Nine- Save money by packing lunch, buying generic, and planning meals ahead of time

Truthfully, I am pretty good when it comes to eating leftovers, but making dinner the night before and having that act as your lunch the next day is a great way to save! (If you can remember to grab the container -cough-HandsomeMan-cough-) I am also a snacker, so unless I want to be running over to Holiday on my break to satisfy my munching habit, I need to buy and pack ahead of time when it comes to snacks. I like Honey Cinnamon Almonds and fruit snacks, both of which you can buy generic versions of to save a few dollars.

Day nine, check.

Day Ten- Find your $20 you hid and spend it on something fun!!!

Really! Her words, not mine, so you have full permission! I bought Handsome Man and I a great big beautiful frame that was on sale, to go in our new apartment next month. This day was great for me because I am so excited about the move, I just want to buy anything and everything that I see to decorate the new space. The permission to spend this day, with the $20 that I saved, was a huge deal.

Day ten, check!!!

Day Eleven- Figure out your housing fees

This includes anything like rent, homeowners association fees, your water, gas, or electric bills, cable, internet, phone bills, etc. I personally already avoid most of these things, so I counted up what it might be for next month instead.

Day eleven, check.

Day Twelve- Find ways to save on your housing fees

There was not much money to be found here for me today. If our apartment didn’t require it, we would not pay for cable, so that would eliminate a $40 some charge each month- but they do. There are ways to bundle your cable and internet and landline (ha, landlines) if you are in the situation like we are. As for electric, turn of your lights! Water? Hurry up those showers. Turn down the heat when you are not home, or leave it down and cozy up with some blankies! I will be keeping it cool in our place and snuggling up with my puppy.

Look at that face. Check.

Day Thirteen- How much did you spend last month on insurance?

We’ve all see the progressive commercials with Flo, I may or may not have also been her for Halloween one year. This does sound a little time consuming but I know you know that there is already one place that lets you shop around for rates, so I don’t want to hear anything about not knowing where to start! Also, I am sure at least ONE of your friends from high school went on to work in insurance so feel free to give them a call to see what they could do for you. Helps you, helps them, win win.

Day thirteen, check.

Day Fourteen- WE DID IT!!! How much did you find?

This is going to be different for everyone, but overall I have to say this challenge created by Rachel Cruze is super easy to follow and even includes some fun days too! Much like the Dave Ramsey debt snowball effect, you start with small tasks and suddenly you could save hundreds. I give this challenge a 10/10 and three gold stars. Share it with your friends and get started today! (Check 😉 )

Next week I am going to dive deep into different money tracking apps to compare them for you. We’ll look at Mint, Everydollar, and a new one called Penny. See you next week!

Sugar and Savings,

Taylor

XOXO