Hello Lovely Savers! Today I wanted to talk about an issue that pulls on my heartstrings… income issues.

“Taylor, why does income pull on your heartstrings?” you might be asking. Because I am a personal finance nerd, obvs. Also, because sometimes, no matter how hard you try to save and budget- the spending isn’t the problem.

I see this with clients every once in a while, they cut EVERYTHING from their budgets and they stick to those budgets like it is their purpose in life, but even with all their sacrifices they can’t get ahead. They feel stuck, and like all the sacrificing wasn’t even worth it, and they feel hopeless. I would know, I’ve been there.

And it’s at this point that I ask them to look outside of the budget, I don’t ask them to try to cut more than they already have. I ask them to look at where the money comes from. There are so many people who work at their jobs for years and they don’t even consider any other options because they are comfortable and it “pays the bills”. But what about when it isn’t paying the bills?

In one of my really old blog posts I talked about leaving the non-profit world because it couldn’t pay the bills (and several other reasons). I felt SO GUILTY leaving the job I had worked so hard to get, and I was made to feel like I was being GREEDY to ask for more hours and thus more money. I left in June that year, and when I did my taxes the following year do you know how much they had paid me in 6 months? $5,000. They wanted me to work there for $10,000 a year. And it wasn’t until that moment that I realized I was right to leave, I am worth more than $10,000 a year.

Sometimes it isn’t even the salary. Occasionally I have had a client, and when we are going over their budget I naturally ask how much they bring home each month, and they explain that it is a little lower than they’d like because they only work 30 hours a week.

“Well”, then I ask, “why do you only work 30 hours a week?”

“Because they only want me to work 30 hours a week.”

Like, I’m sorry, what? Then they can find someone else to work 30 hours per week! And I understand that some people have limitations and that inhibits them from being able to work 40 hours, I am obviously not talking about that in this scenario. If you WANT to work 40 hours per week, then find a job that will pay you to work 40 hours a week!

It’s also my experience that if a job is only willing to pay for a half-time employee or a part-time employee (less than 40 hours per week), then they are NOT giving competitive compensation. And they are probably not providing benefits either.

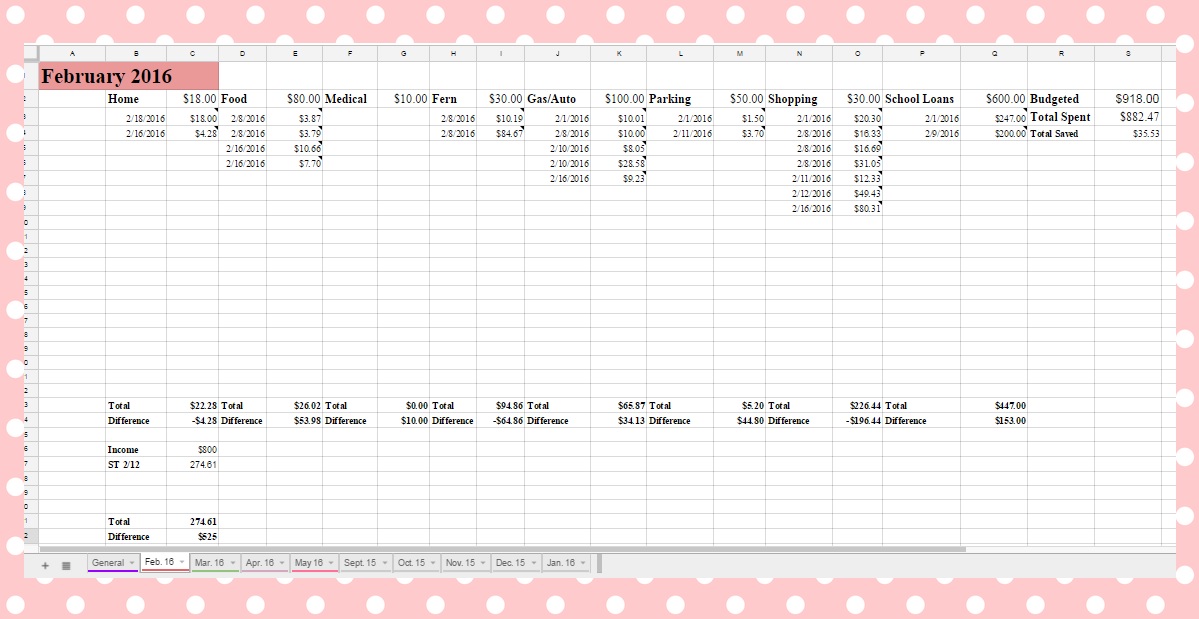

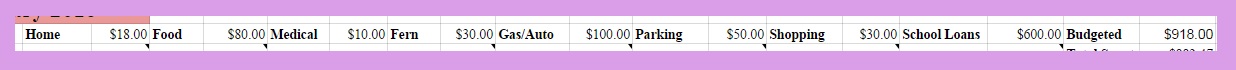

Even if you are an Administrative Assistant, and they pay you $18/hour which is the going rate for Administrative Assistants in your area, if you are only scheduled for 30 hours per week you are making less than $600 per week. If you worked 40 hours you’d be making a little over $700. And sure, that $100 doesn’t seem like a ton in the grand scheme of things, but if your financial goals could really use that $100, it isn’t anything to sneeze at. AND if you don’t receive benefits from work, and you have to supply them yourself, you might be out another couple hundred per month to pay for things like health insurance and dental and vision, etc.

I am not suggesting that anyone working less than 40 hours should go get a second job to compensate for the missing income, if you want to, go for it. If you find somewhere willing to hire you for 10 hours a week, they probably are not paying higher than minimum wage, and it might not be worth the stress.

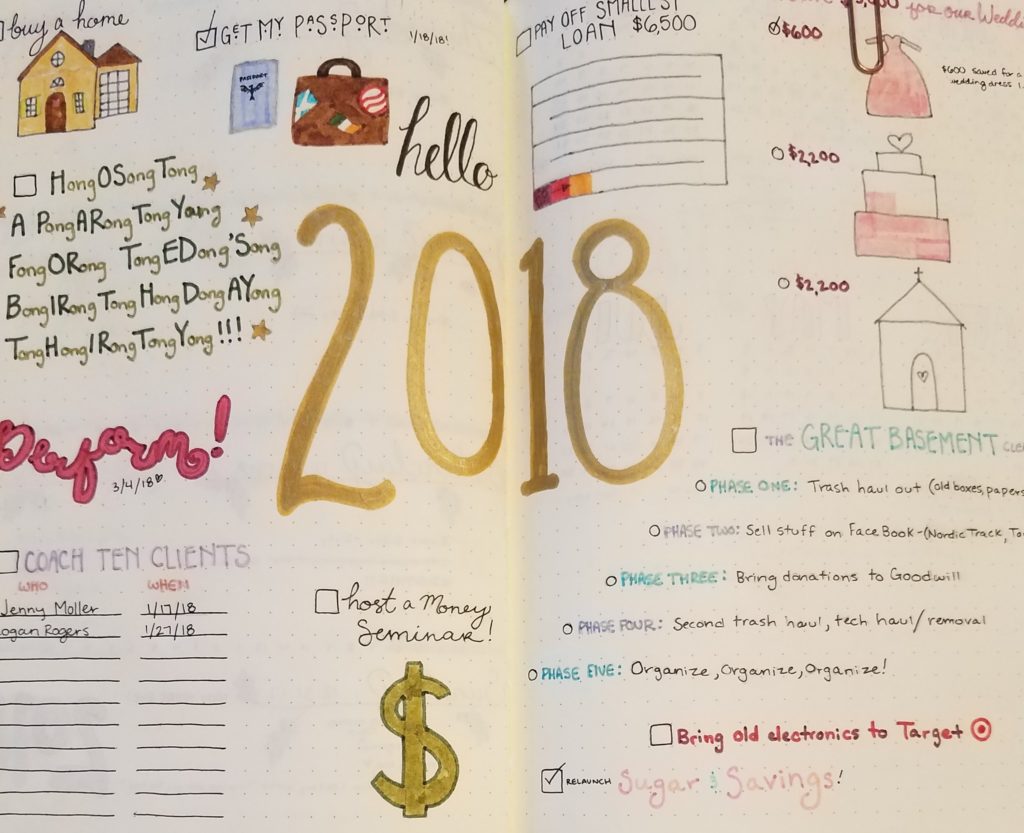

What I am really suggesting is that you determine what your goals need, and if they need more income to make them a reality, don’t be afraid to ask for it or find it somewhere else.

YOU ARE NOT OWNED BY YOUR EMPLOYER. You may feel loyalty toward them, toward the job and your coworkers, but no one can hold you back from reaching YOUR goals. As disheartening as it is, if you leave, they will replace you.

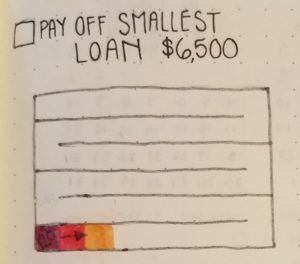

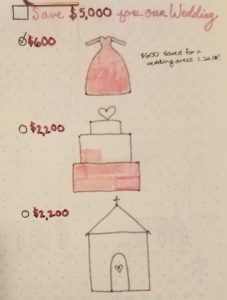

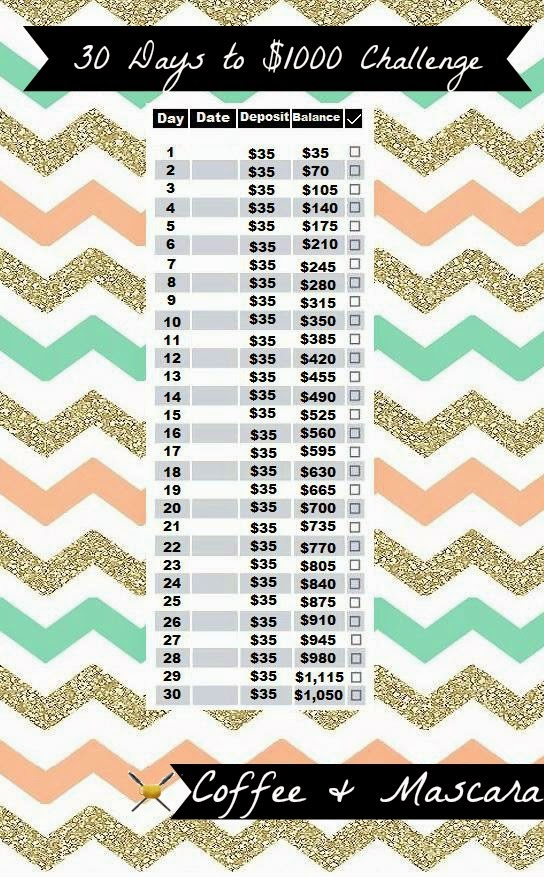

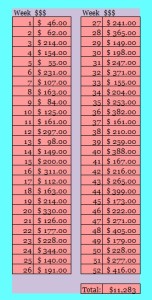

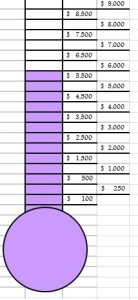

So there you have it Lovely Savers. If you have worked your butt off to stick to a budget, and cut the cable and all the fun stuff, and you STILL can’t make it past Baby Step One ($1,000 Emergency Savings)- time to look outside of spending. Is there enough coming in? If not, what are you willing to do about that?

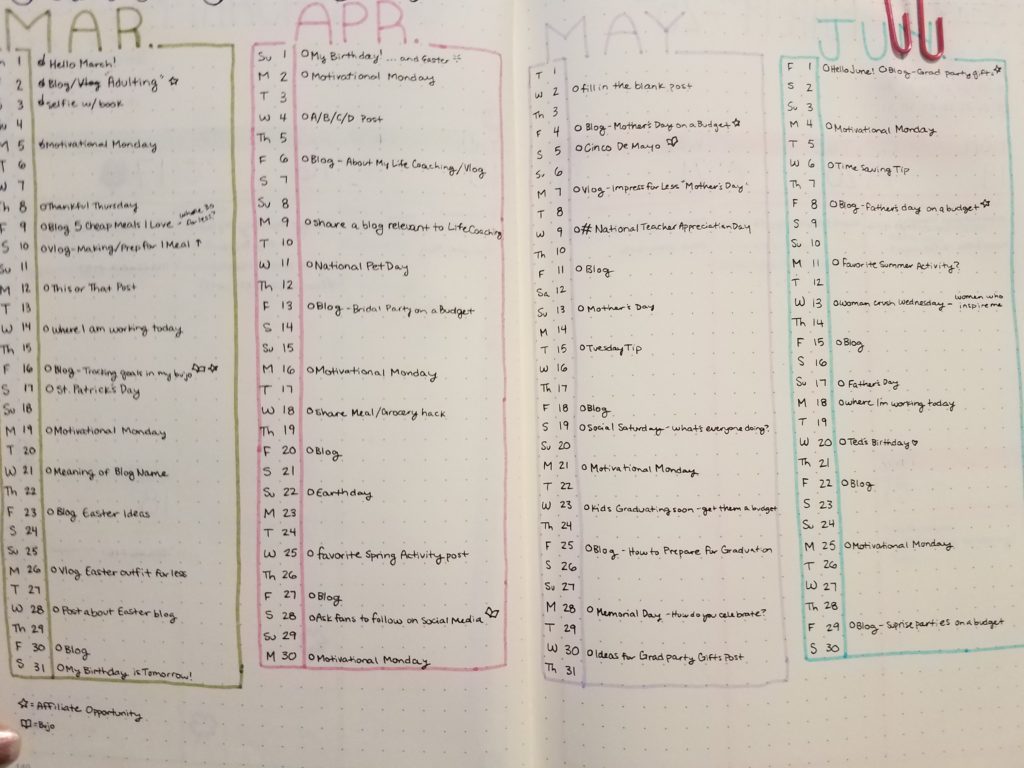

Sorry that today’s blog might be a little bit of a downer, but thank you so much for all of your support, Lovely Savers! I love sharing my tips and tricks for money and how to deal with everything in between. Please join the Facebook Group: Sugar and Savings- Budgets and Saving Money to be a part of our community of other lovely savers. We share our thoughts, and plans with money, and we celebrate each other’s wins! And each month I go live to answer YOUR questions about personal finance!

Until next time, wishing you all Sugar and Savings,